- Posted by:

- Posted on:

- Category:

Real EstateReal Estate - System:

Unknown - Price:

USD 0

Real Estate Market Fluctuations in the Past: Key Historical Trends

The real estate market has always been subject to fluctuations, driven by a variety of economic, social, and political factors. Throughout history, the dynamics of real estate have shifted dramatically, influenced by wars, economic depressions, technological advancements, and policy changes. Understanding these historical trends is essential for anyone looking to comprehend the cyclical nature of the real estate market and how it can shape future investment strategies. In this article, we’ll explore key historical trends in real estate market fluctuations, focusing on the major events and shifts that have defined the housing market over time.

The Great Depression and the Housing Market Crash (1930s)

One of the most significant events in the history of real estate fluctuations occurred during the Great Depression of the 1930s. The stock market crash of 1929 sent shockwaves through the global economy, leading to widespread unemployment, bank failures, and a severe drop in consumer spending. The housing market, which had already been experiencing a period of rapid growth, was devastated by the collapse of the economy.

During the 1920s, there was a housing boom in the United States, fueled by easy credit and speculative investment in real estate. However, the collapse of the stock market led to widespread foreclosures and a dramatic decrease in property values. By the early 1930s, millions of Americans lost their homes, and the real estate market came to a near standstill.

In response to this crisis, the U.S. government introduced several initiatives to stabilize the housing market. The creation of the Federal Housing Administration (FHA) in 1934 and the establishment of the Home Owners’ Loan Corporation (HOLC) helped refinance homes and restore confidence in the housing market. These efforts, along with the introduction of the GI Bill after World War II, eventually led to a recovery in the housing market. However, the Great Depression marked a profound low point in real estate, shaping the market for decades to come.

Post-World War II Suburban Boom (1940s-1960s)

Following the end of World War II, the U.S. housing market experienced a dramatic shift. With millions of soldiers returning home, there was a massive demand for housing, leading to a suburban boom in the late 1940s and 1950s. The Federal Housing Administration (FHA) played a key role in this expansion by providing low-interest loans and promoting homeownership as a goal for American families.

Suburbanization became a dominant trend during this period. As cities became more crowded, many families moved to newly developed suburban areas, drawn by the promise of affordable housing, larger homes, and access to better schools. Developers like William Levitt were pioneers in creating mass-produced suburban homes, making homeownership accessible to a larger portion of the population.

The post-WWII era also saw the rise of the automobile, which made it easier for people to live farther from city centers while still maintaining a reasonable commute. This shift in living patterns caused urban sprawl, as the demand for suburban properties soared. The combination of government-backed financing and the desire for a suburban lifestyle led to a period of unprecedented growth in the housing market.

However, this boom was not without its challenges. The rise of suburbia contributed to the decline of inner-city neighborhoods, as wealthier families moved to the suburbs, leaving behind urban areas with fewer resources. This period also saw the beginning of racial segregation in housing, with discriminatory practices like redlining preventing African Americans and other minorities from accessing the same housing opportunities as white Americans.

The Housing Bubble of the 1980s and Early 1990s

The 1980s marked another period of significant fluctuation in the real estate market, largely driven by economic factors such as inflation, interest rates, and the deregulation of financial markets. In the early part of the decade, the United States experienced high inflation, which led the Federal Reserve to raise interest rates to control inflation. This, in turn, made mortgages more expensive and reduced the demand for housing.

However, by the mid-1980s, the economy began to recover, and the real estate market once again became an attractive investment option. Home prices began to rise, and speculative buying increased, particularly in urban areas. At the same time, the government introduced tax reforms, including the Tax Reform Act of 1986, which eliminated some of the incentives for real estate investors, particularly in the commercial sector.

By the late 1980s and early 1990s, a real estate bubble was forming, particularly in regions like California, New York, and parts of Florida. The bubble was fueled by easy credit and overleveraging by both homebuyers and investors. Many people purchased properties with the hope that prices would continue to rise, without fully understanding the risks involved.

When the bubble burst in the early 1990s, the housing market crashed. Home prices plummeted, and many people found themselves underwater on their mortgages, meaning they owed more than their homes were worth. The savings and loan crisis, which saw numerous financial institutions fail, was a direct consequence of the speculative real estate practices that had fueled the bubble.

The 2008 Housing Crisis: The Subprime Mortgage Meltdown

Perhaps the most infamous real estate crash in recent history occurred in 2008, when the subprime mortgage crisis triggered a global financial meltdown. Leading up to the crisis, financial institutions began offering risky loans to homebuyers who had poor credit histories—referred to as subprime borrowers. These risky loans were bundled into mortgage-backed securities (MBS) and sold to investors, creating a false sense of security in the housing market.

At the same time, housing prices were skyrocketing due to speculation and easy credit. As home prices continued to rise, many people believed that real estate was a safe and profitable investment. However, when the housing market became oversaturated and home prices began to fall, many subprime borrowers were unable to make their mortgage payments. This triggered a wave of foreclosures, which led to a sharp decline in property values.

The collapse of Lehman Brothers in September 2008 marked the tipping point of the financial crisis, which had far-reaching effects on the real estate market. The housing bubble burst, and home prices plummeted, leaving millions of homeowners with negative equity. The collapse also led to a severe credit crunch, making it more difficult for individuals and businesses to obtain financing. The aftermath of the 2008 crisis led to a prolonged period of stagnation in the housing market, with many homeowners still struggling with foreclosure and declining property values.

Post-2008 Recovery and Current Trends

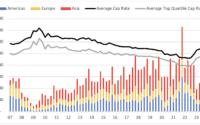

In the years following the 2008 housing crisis, the real estate market began to recover, but the road to recovery was long and slow. A combination of government intervention, such as the Troubled Asset Relief Program (TARP), and new regulations on lending practices helped stabilize the market. Additionally, low interest rates and an improving economy encouraged homebuyers to return to the market.

In recent years, the real estate market has been characterized by rising home prices and limited housing inventory. Factors such as the increasing demand for homes, low mortgage rates, and supply chain disruptions have contributed to rising prices, particularly in urban areas. At the same time, concerns about affordability have prompted calls for increased housing development and reform of zoning laws.

Additionally, the COVID-19 pandemic has introduced new challenges to the housing market. The pandemic caused a shift in how people view their living spaces, with many opting for larger homes or properties in suburban and rural areas. Remote work and the desire for more space have driven demand for housing in these areas, further affecting market trends.

Conclusion

The history of real estate market fluctuations provides valuable insights into how economic, social, and political factors shape the housing market. From the Great Depression to the subprime mortgage crisis, each major market shift has left a lasting impact on the way buyers and sellers approach real estate. While the market is cyclical, understanding past trends can help investors, homeowners, and policymakers make informed decisions about the future of real estate. By studying historical trends, we can gain a deeper appreciation for the factors that drive market changes and better prepare for the next wave of real estate fluctuations.